Running a successful business requires more than just selling products or services—it also means keeping an accurate track of your money. One of the most important yet often overlooked practices in financial management is financial reconciliation. This process ensures that your records match the actual money moving in and out of your business. Without it, errors, fraud, and financial mismanagement can go undetected, leading to long-term problems that may hurt growth and profitability.

For entrepreneurs, especially those scaling their businesses, understanding financial reconciliation is non-negotiable. This guide explores what financial reconciliation is, why it’s essential, how to do it effectively, and what tools can make the process easier. By the end, you’ll not only understand its importance but also gain actionable strategies to implement it in your own business.

Understanding the Basics: What Is Financial Reconciliation?

Financial reconciliation is the process of comparing two sets of financial records to ensure they match. In simple terms, it’s about checking whether the numbers in your internal books—such as your accounting software, ledgers, or spreadsheets—align with external records, such as bank statements, invoices, receipts, or credit card transactions.

For entrepreneurs, reconciliation is crucial because it acts as a safety check. Errors can happen—whether it’s a double entry, a missing transaction, or even fraud. By performing reconciliations regularly, you can spot discrepancies early and fix them before they snowball into bigger issues.

Think of it this way: reconciliation is like balancing your personal checkbook but on a larger, more detailed scale. For businesses, this practice not only ensures accuracy but also builds trust with investors, partners, and financial institutions. It lays the foundation for sound financial management and strategic decision-making.

Why Financial Reconciliation Is a Must for Entrepreneurs

Every entrepreneur juggles multiple responsibilities—sales, operations, marketing, and people management. But overlooking finances, especially reconciliations, can be costly. Financial reconciliation matters because it gives you confidence in your numbers, and accurate numbers are critical for making the right business decisions.

When reconciliations are ignored, your books may show profits when you’re actually losing money. Or worse, you may miss fraudulent transactions that chip away at your bottom line. Accurate financial data enables you to:

- Plan budgets effectively

- Manage cash flow with confidence

- Prepare accurate tax filings

- Demonstrate financial health to lenders and investors

- Avoid penalties from compliance issues

In short, reconciliation is not just an accounting exercise—it’s a risk management tool. Entrepreneurs who take it seriously position themselves for long-term stability and growth.

The Different Types of Financial Reconciliation

Financial reconciliation comes in several forms, each serving a unique purpose in safeguarding your business finances. Understanding these types helps entrepreneurs decide how often and where to apply reconciliation practices.

- Bank Reconciliation

Compares your business’s cash book with bank statements to ensure all deposits, withdrawals, and fees match. - Vendor Reconciliation

Matches accounts payable records against vendor statements to confirm all bills are paid correctly and on time. - Customer Reconciliation

Ensures accounts receivable records align with payments received from customers, avoiding missed or delayed collections. - Credit Card Reconciliation

Compares credit card statements with internal expense records to prevent oversights and catch unauthorized transactions. - Payroll Reconciliation

Matches payroll records against disbursements and tax filings to confirm employees are paid accurately and compliance is met.

Each type of reconciliation contributes to financial transparency. Entrepreneurs don’t have to perform all of them daily, but regular reviews, especially of bank and vendor records, are vital.

What Is Financial Reconciliation in Practice? (Step-by-Step Process)

Understanding the concept is one thing, but applying financial reconciliation in day-to-day business is another. Here’s how entrepreneurs can carry out reconciliation effectively:

- Gather Records

Collect internal accounting records and external documents such as bank statements or vendor invoices. - Compare Entries

Line up each transaction from your records with the external data to check for consistency. - Identify Discrepancies

Look for mismatched amounts, missing entries, or duplicate records. - Investigate Issues

Determine the root cause of discrepancies—was it human error, system lag, or fraudulent activity? - Make Adjustments

Correct the errors by updating your books or reaching out to financial institutions if external records are inaccurate. - Document the Process

Keep a record of reconciliations for audits, compliance, and future reference.

This structured approach saves entrepreneurs from relying on guesswork and ensures accountability in their financial systems.

Common Mistakes to Avoid During Financial Reconciliation

Even with the best intentions, reconciliation errors happen. Entrepreneurs should be aware of common pitfalls that can derail the process.

- Infrequent Reconciliation: Waiting months before reviewing accounts can make discrepancies harder to trace.

- Overreliance on Automation: Software helps, but human review is still necessary to catch unusual patterns.

- Incomplete Documentation: Failing to keep records of reconciliations weakens your financial trail.

- Ignoring Small Discrepancies: Small errors often point to larger systemic issues if left unchecked.

- Poor Communication: Lack of coordination between accounting, operations, and management teams can lead to gaps in data.

By recognizing these mistakes, entrepreneurs can refine their processes and make reconciliation more reliable.

The Role of Technology in Financial Reconciliation

Modern businesses don’t need to reconcile finances manually with pen and paper. Today, advanced accounting and reconciliation software streamline the process, reducing human error and saving valuable time.

Tools like QuickBooks, Xero, or specialized reconciliation platforms automatically import transactions, flag discrepancies, and generate reports. Artificial intelligence (AI) and machine learning are even helping businesses predict potential mismatches and identify fraudulent activities before they escalate.

For entrepreneurs, adopting reconciliation technology means:

- Faster turnaround on financial reporting

- Improved accuracy in records

- Integration with banking systems and payment platforms

- Real-time visibility into cash flow

Technology doesn’t replace financial oversight, but it enhances it. Entrepreneurs who embrace automation free themselves to focus more on strategy and growth.

Financial Reconciliation and Fraud Prevention

Fraud is a serious threat to small and growing businesses. According to global reports, billions are lost annually to fraudulent activities—often due to weak financial controls. Reconciliation is one of the most effective defenses against this.

By systematically matching records, entrepreneurs can detect:

- Unauthorized withdrawals

- Duplicate vendor invoices

- Inflated expense claims

- Missing deposits

Timely detection means you can act before losses become irreversible. Moreover, consistent reconciliation builds a culture of accountability, where employees know financial oversight is taken seriously.

How Often Should Entrepreneurs Perform Reconciliation?

There’s no one-size-fits-all answer to how often reconciliation should occur. The frequency depends on business size, transaction volume, and industry regulations.

- Daily: High-volume businesses, such as retail or e-commerce, benefit from daily bank reconciliations.

- Weekly: Medium-sized businesses with steady cash flows may reconcile once a week.

- Monthly: For smaller operations, a monthly reconciliation aligned with bank statements is often sufficient.

Ultimately, the more often you reconcile, the faster you catch errors. Entrepreneurs should weigh the time and cost of reconciliation against the risks of inaccuracies.

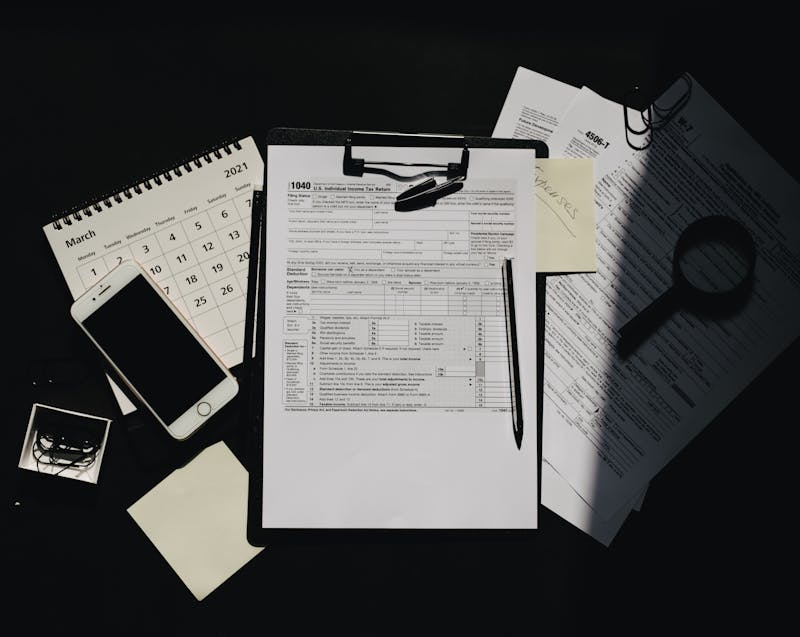

Financial Reconciliation and Compliance

Beyond internal benefits, reconciliation also ensures compliance with external regulations. Tax authorities, investors, and lenders expect accurate records. Inaccurate or incomplete financial statements can lead to:

- Fines and penalties

- Damaged credibility with stakeholders

- Delays in securing loans or investments

- Increased audit risks

By prioritizing reconciliation, entrepreneurs not only meet compliance requirements but also build trust with key partners. A reconciled account is proof of professionalism and transparency.

The Cost of Ignoring Financial Reconciliation

Many entrepreneurs underestimate the hidden costs of neglecting financial reconciliation. At first glance, skipping this process might seem like saving time and effort, but in reality, it often leads to bigger financial headaches down the road. Inaccurate books can create cash flow miscalculations, missed tax deductions, and even penalties for late or incorrect filings. Over time, these issues compound and could put your business’s survival at risk. Some of the major consequences include:

- Inaccurate Cash Flow Forecasting – Without reconciled accounts, it’s difficult to know how much money is truly available.

- Higher Audit Risks – Discrepancies increase the chances of costly and time-consuming audits.

- Missed Growth Opportunities – Entrepreneurs may hesitate to expand or invest if they lack reliable financial data.

- Damaged Reputation – Inconsistent financial reporting can weaken trust with lenders, investors, and partners.

In short, failing to reconcile regularly costs much more than the time saved. It’s an investment in financial health and long-term stability.

Building a Strong Reconciliation Routine for Your Business

Financial reconciliation delivers the most value when it becomes a consistent habit. Entrepreneurs should aim to design a clear routine that works for their business size and industry. Consistency builds confidence in your numbers and makes discrepancies easier to identify. A good reconciliation routine often includes:

- Scheduling Regular Reviews – Decide whether daily, weekly, or monthly reconciliations best suit your transaction volume.

- Using the Right Tools – Adopt accounting software that integrates with bank feeds and automates repetitive tasks.

- Assigning Clear Responsibilities – Designate specific team members (or yourself, if solo) to handle reconciliations.

- Keeping Records Organized – Store invoices, receipts, and statements systematically for quick access.

- Reviewing Reports with Management – Go beyond numbers; use reconciled data to guide strategy discussions.

By building a routine, entrepreneurs transform reconciliation from a reactive chore into a proactive financial safeguard. This not only improves accuracy but also instills discipline, helping businesses scale with confidence.

Why Financial Reconciliation Is the Foundation of Smart Business Decisions

Entrepreneurs succeed when they make informed decisions. Whether it’s pricing products, hiring staff, or expanding operations, every decision hinges on reliable financial data. Reconciliation provides that reliability.

With reconciled accounts, you can:

- Accurately measure profitability

- Identify cost-cutting opportunities

- Manage debt effectively

- Forecast growth with confidence

Without it, decisions are based on incomplete or misleading information—an unnecessary risk for any entrepreneur serious about growth.

Final Thoughts

So, what is financial reconciliation, and why does it matter for your business? Put simply, it’s the backbone of financial accuracy and business health. For entrepreneurs, it ensures that your records are correct, your cash flow is clear, and your decisions are grounded in reality.

From preventing fraud to satisfying regulators and building investor confidence, reconciliation is far more than an accounting task—it’s a strategic advantage. Entrepreneurs who embrace regular reconciliation and leverage modern tools not only avoid costly mistakes but also set their businesses up for sustainable success.